After reading the whole analysis, I really think that I am a self-conflicting person because my risk tolerance and risk-taking behavior are not the same. More towards the safe side. Sienzzz....

Take a free risk tolerance test from FinaMetrica

Your Risk Tolerance Score

Your Risk Tolerance Score enables you to compare yourself to a representative sample of the adult population. Your score is 70. This is a very high score, higher than 97% of all scores.

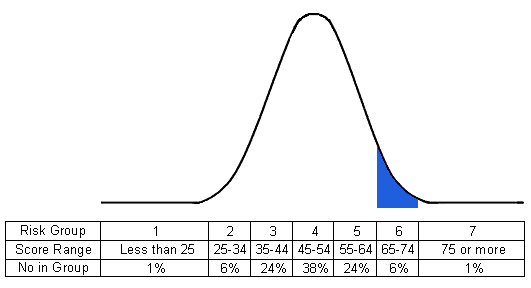

When scores are graphed they form a bell-curve as shown below. To make the scores more meaningful, the 0 to 100 scale has been divided into seven Risk Groups. Your score places you in Risk Group 6.

In answer to the last question, you estimated your score would be 70. Congratulations! You picked your score exactly. Most people under-estimate their score by a few points.

Your Risk Group

The description of Risk Group 6 which follows provides a summary of the typical attitudes, values, preferences and experiences of those in your group. Five of your answers differed from this description. They are shown in italics below the relevant section. These differences fine-tune the description to you personally.

Making Financial Decisions

Most commonly they think of "risk" as "opportunity". They have a great deal of confidence, if not complete confidence, in their ability to make good financial decisions and usually feel very, or at least somewhat, optimistic about their major financial decisions after they make them.

They are prepared to take a large degree of risk with their financial decisions and are usually, if not always, more concerned about the possible gains than the possible losses.

You think of "risk" as "danger".

You have only a reasonable amount of confidence in your ability to make good financial decisions.

You are prepared to take a very large degree of risk with your financial decisions.

When faced with a major financial decision you are usually, more concerned about the possible losses.

Financial Disappointments

Typically, when things go wrong financially they adapt somewhat, if not very, easily.

Financial Past

Most have taken a large degree of risk with their past financial decisions. Most have also borrowed money to make an investment. About half have invested a large sum in a risky investment mainly for the "thrill" of seeing whether it went up or down in value.

Investment

They feel it is much more important that the value of their investments retains its purchasing power than that it does not fall. Over ten years, they expect an investment portfolio to earn, on average, at least three times the rate from CDs (certificates of deposit). Typically, they would begin to feel uncomfortable if the total value of their investments went down by 33%.

Given these portfolio choices,

Expected Return and RiskHigh Medium Low

Portfolio 1 0 % 0 % 100 %

Portfolio 2 0 % 30 % 70 %

Portfolio 3 10 % 40 % 50 %

Portfolio 4 30 % 40 % 30 %

Portfolio 5 50 % 40 % 10 %

Portfolio 6 70 % 30 % 0 %

Portfolio 7 100 % 0 % 0 %

where stocks and real estate are high return/high risk and cash and CDs are low return/low risk, their most common choice is Portfolio 6.

It is somewhat more important that the value of your investments does not fall (than that it retains its purchasing power.)

Borrowing

If they were borrowing a large sum of money at a time when it was not clear which way interest rates were going to move and when the fixed interest rate was 1% more than the then variable rate, they would choose to have at least 50% of the loan at variable interest.

Government Benefits and Tax Advantages

So long as there was more than a 50% chance they would finish up better off than if they'd done nothing, they would take a risk in arranging their affairs to qualify for a government benefit or obtain a tax advantage.

No comments:

Post a Comment